How to Stake SLRS

Staking SLRS has many benefits to users on the Solrise platform.

When Fund Managers stake SLRS, they reduce the share of performance fees taken by the Solrise Protocol. When Investors stake SLRS, they receive a discount on their exit fees. The more SLRS that’s staked, the better the benefits. The longer you lock up your staked SLRS, the higher reward you receive. The lockup schedule and corresponding APR is below.

This guide assumes you already have SLRS in your wallet. These steps are shown in the mobile app but the process is the same on the web version of the wallet.

No Lockup: 8% APR

30 Days: 16% APR

90 Days: 24% APR

180 Days: 32% APR

365 Days: 40% APR

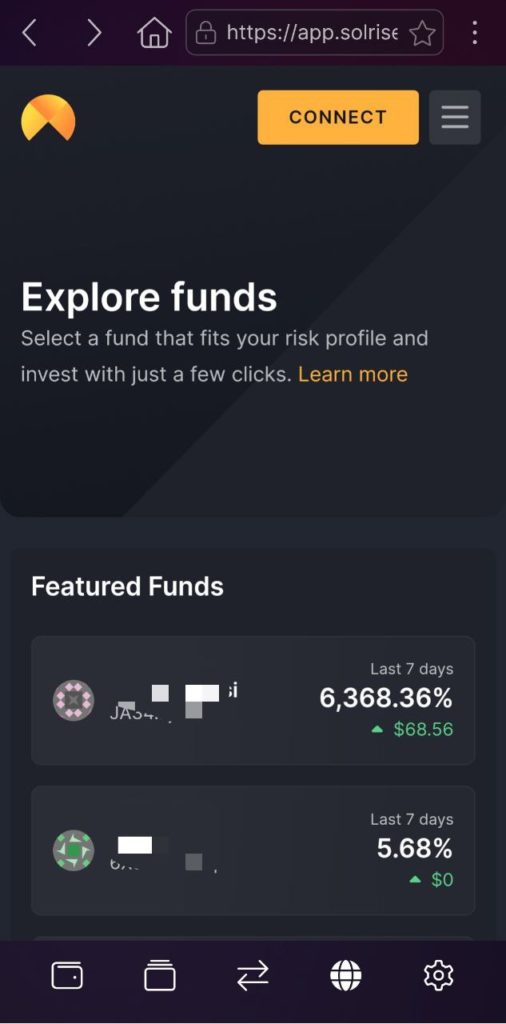

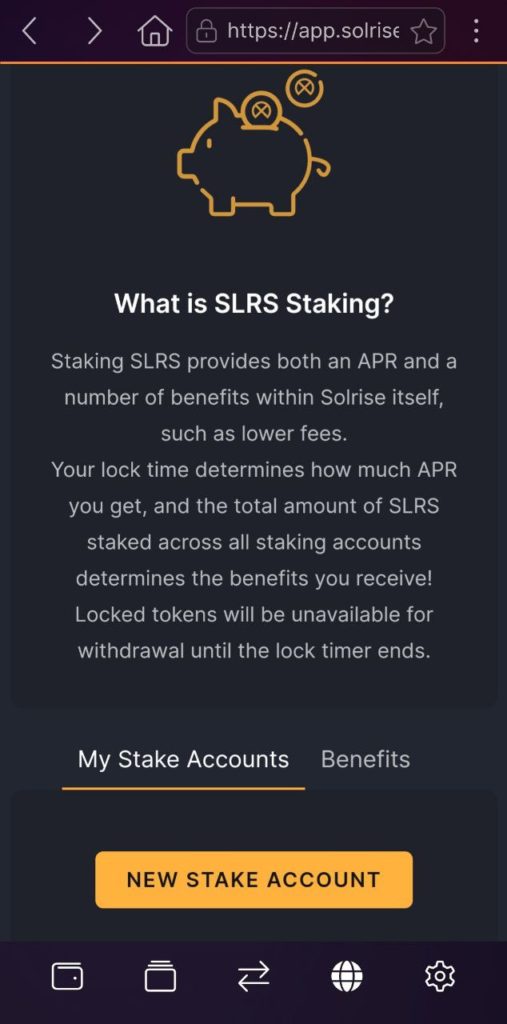

Step 1

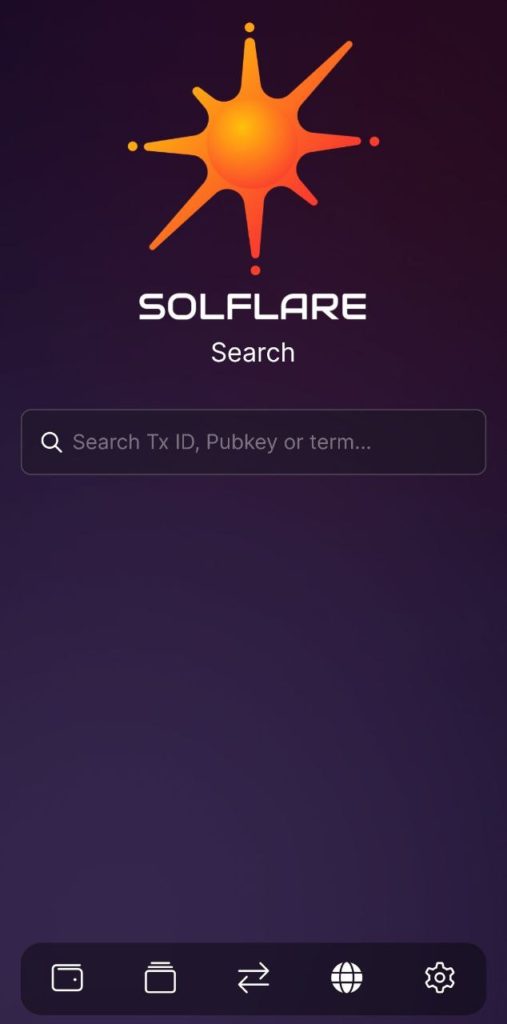

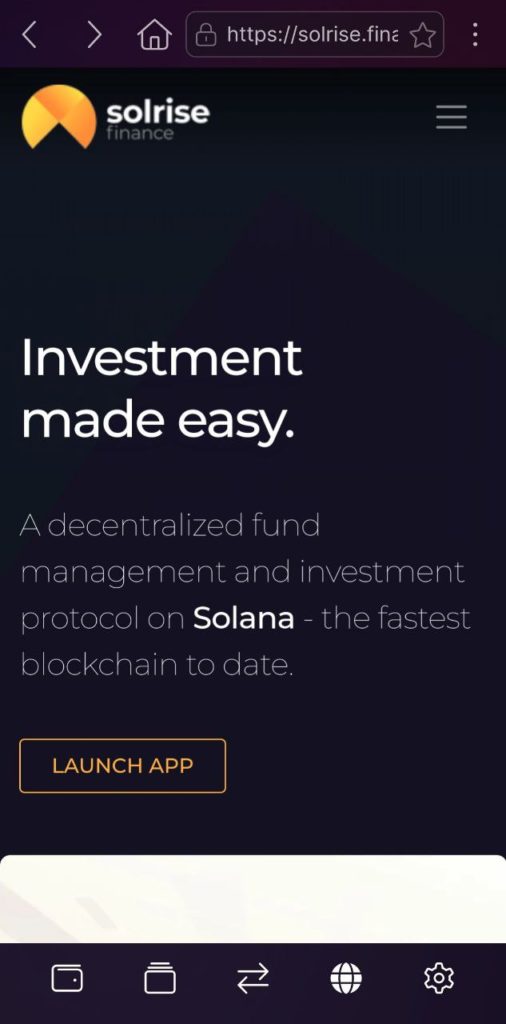

- Go to the Browser tab and search Solrise.Finance.

- From there, click Launch App.

Step 2

- After launching the app, you’ll be taken to the home screen of Solrise.

- Click on the top right Connect Wallet.

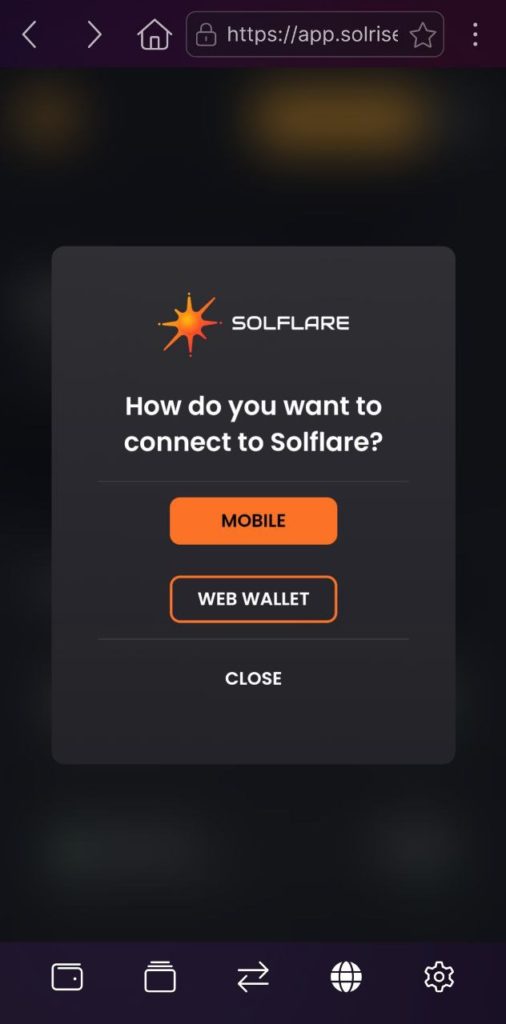

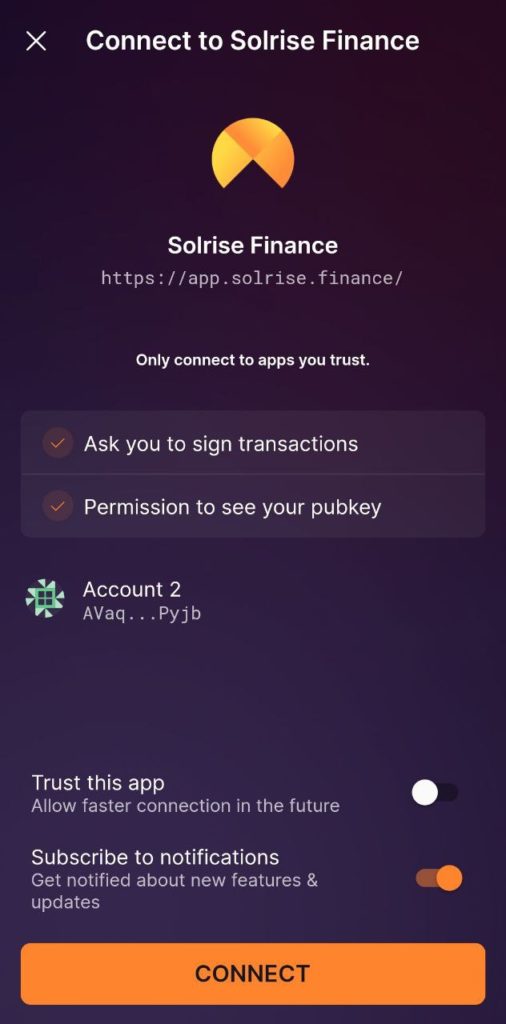

Step 3

- Click Solflare.

- Click Mobile.

- Click Connect.

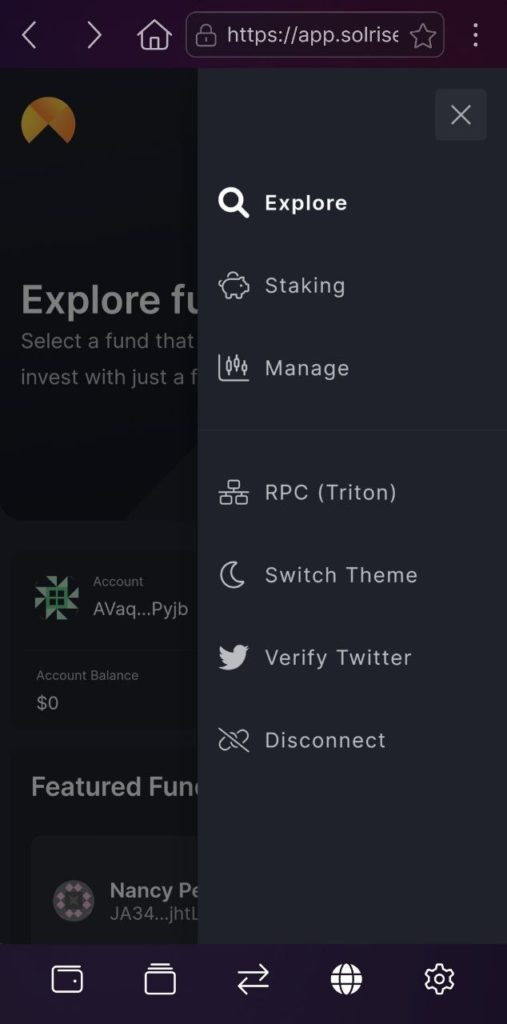

Step 4

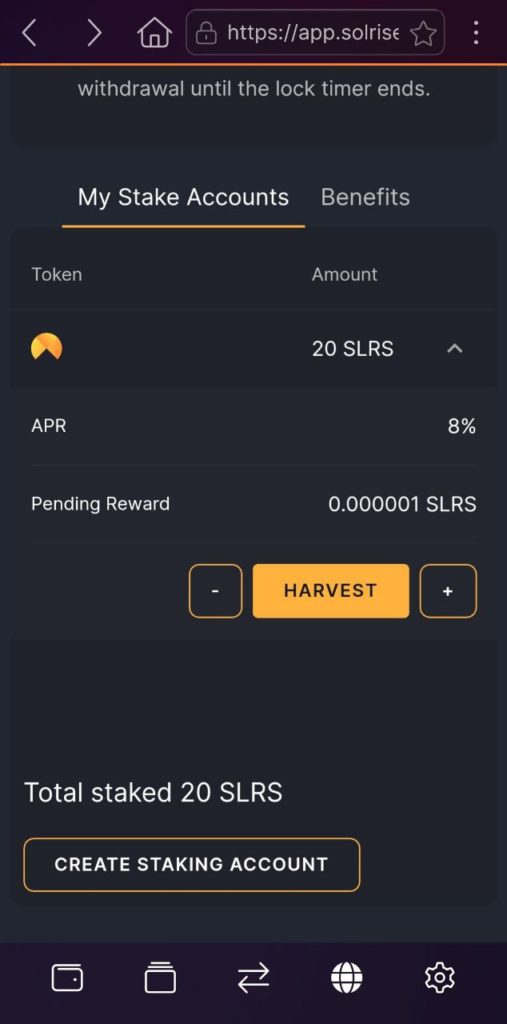

- Click on the Staking page listed on the drop down menu mentioned in Step 2.

- From here, you can access all your SLRS staking accounts.

- Scroll to the bottom and click Create Staking Account.

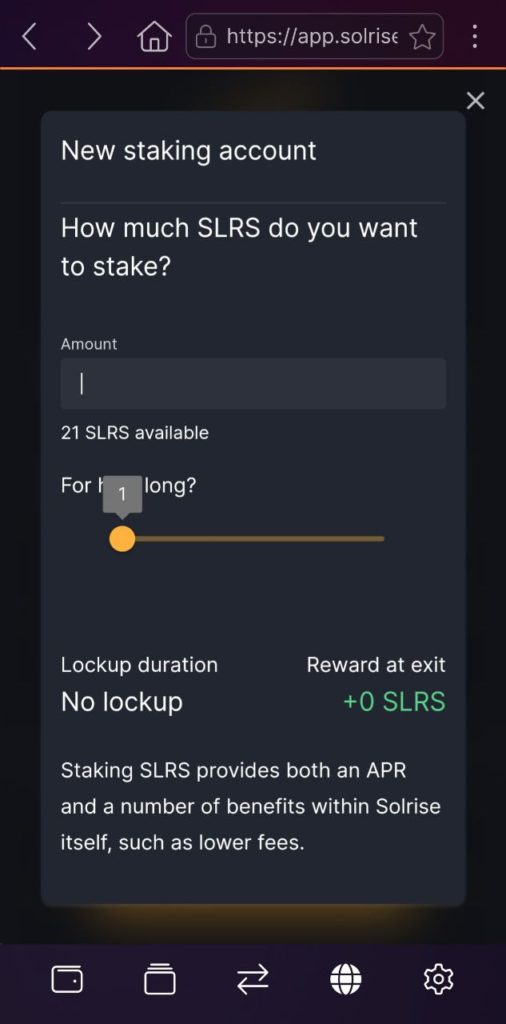

Step 5

- Choose how much SLRS you want to stake and for how long.

- No Lockup: 8% APR

- 30 Days: 16% APR

- 90 Days: 24% APR

- 180 Days: 32% APR

- 365 Days: 40% APR

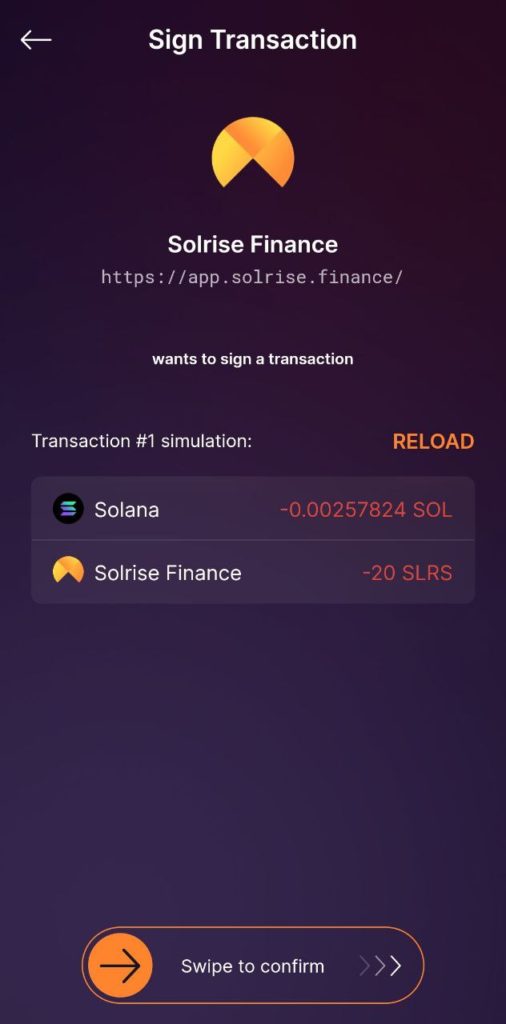

- Once you’ve chosen the above parameters, scroll to the bottom and click Stake SLRS and swipe to confirm the transaction.

That’s it!

You’ve now successfully staked your SLRS.

Sit back and watch those rewards accumulate!

If you chose to not lock the staked SLRS for any amount of time, you can harvest your rewards whenever you want.

Otherwise, you’ll have to wait until the date listed on your Staking Account.